Events and Dividends: Volatility Term Structure's Effect on Early Exercise

Is your option pricer overlooking volatility term structure? Imagine you're pricing an American call option on a stock that's facing a cash dividend and then a major earnings event before expiration. The stock's volatility will spike around the event but remain typical before and after it. If your pricer simply averages volatility over the entire period, it may overprice the call option. This overpricing occurs because the potential for early exercise—especially before the stock goes ex-dividend—is overestimated. The average volatility assumption can understate the time value of the option after the dividend, leading to incorrect pricing. Our option pricer captures the full volatility term structure, ensuring precise pricing, even in complex scenarios.

Settlement Rules: The Hidden Cost of Ignoring T+1

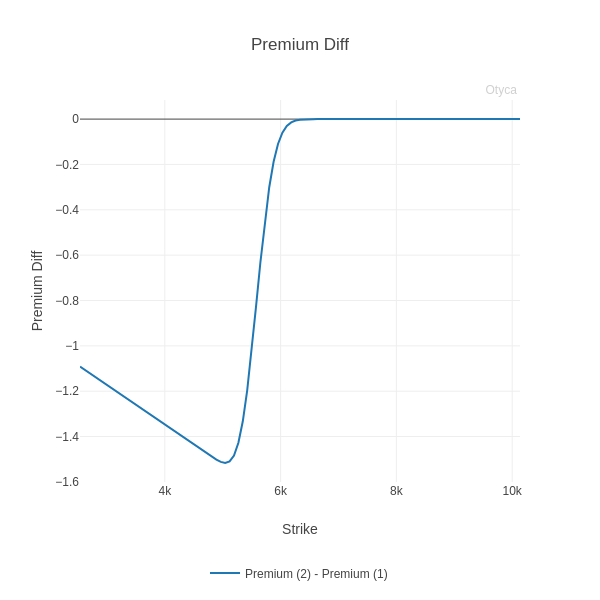

Is your option pricer unaware of settlement rules? In the U.S., stocks, ETFs, and their options follow a T+1 settlement schedule. If you trade on a Monday, payment and delivery occur on Tuesday (assuming no holidays). On expiration day, typically a Friday, any exercised option will settle the following Monday. If your pricer ignores this settlement detail, it could miscalculate the delta hedging financing cost by a few days. This mispricing can significantly impact your results. For example, with a 50 delta SPY option, an underlying price of $500, 2 miscalculated days, and a 5% interest rate, the error could amount to nearly 7 cents—seven times the bid-ask spread for that option. Our option pricer accurately factors in settlement rules, giving you precise pricing every time.

Dividends Modeling: Fixed and Proportional

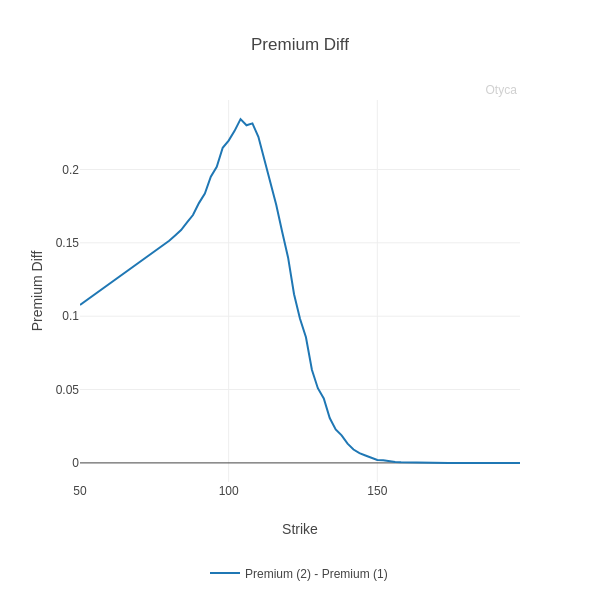

How does your pricer model dividends? Where on the time grid do you place dividends? If a stock goes ex-dividend on a certain day, dividends impact early exercise, which is highly sensitive to the remaining time value of the option. Since clearing houses have cut-off times for early exercise instructions (e.g., the OCC's 5:30 PM Eastern Time in the U.S.), if your pricer places dividends later than this cut-off time, it will overstate the early exercise premium. For longer-dated options, dividends are often treated as a mix of fixed cash amounts and amounts proportional to the underlying price. Can your pricer accurately handle this mixture of fixed cash and proportional dividends? Our option pricer precisely models dividends, ensuring accurate pricing under all scenarios.

Pricing Consistency: Spot Volatility

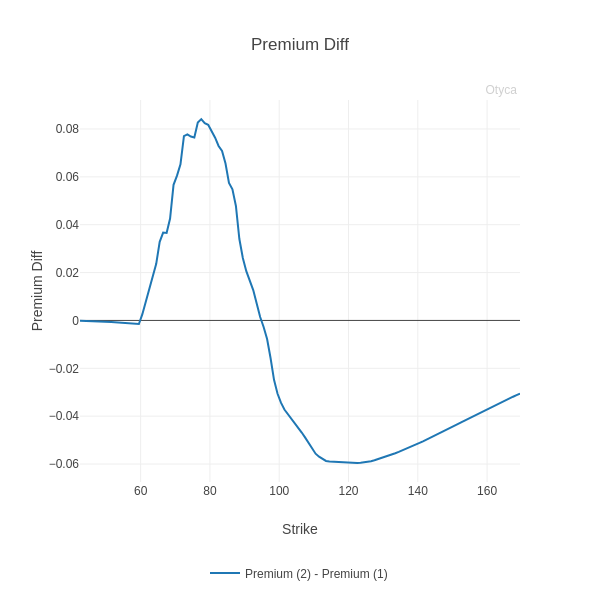

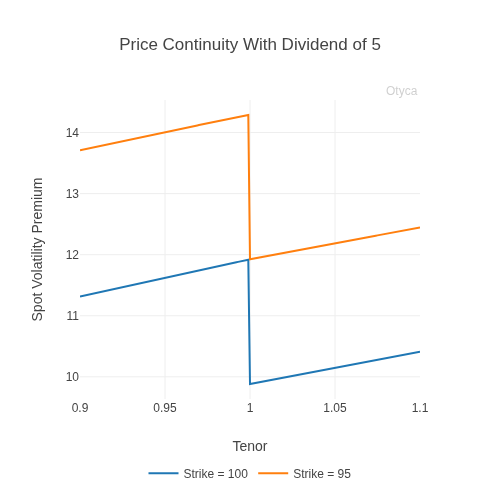

Do you rely on traditional forward price via dividend discounting method when pricing options on underlyings that pay discrete cash dividends? This approach effectively models the forward price returns, and volatility is of that forward. While straightforward, it introduces inconsistencies across expirations because the forward price is inherently expiration-dependent. Consider a simple question: when you price an option expiring before an ex-dividend date, should you include that future dividend in the pricing input? If you do, then you are letting dividends paid after the option’s expiry affect its value — which makes no economic sense. If you don’t, then options expire after the ex-dividend date are priced on different forward prices, and their implied volatilities are measured on inconsistent price bases, making them non-comparable. For example, an option that expires just before a dividend and another that expires just after, with strikes differing exactly by the dividend amount, should have nearly identical values. Under the "forward volatility" approach, they don’t. Furthermore, realized volatilities are almost always calculated using returns on spot prices, not on forward prices. Our pricer resolves these inconsistencies by modeling the spot price returns, so volatility is measured with respect to the spot price rather than the forward price. This not only ensures consistent pricing of options across expirations and around dividend dates, but also stays consistent with the way realized volatility is observed and estimated.

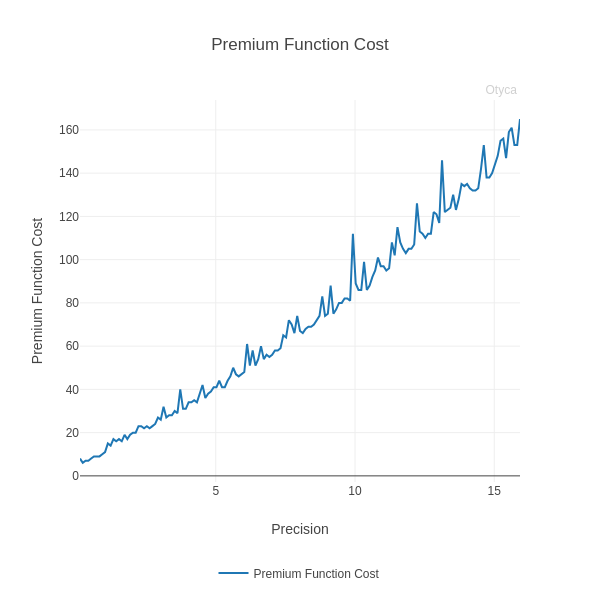

Speed and Accuracy: Microseconds Pricing with 1 bps Precision

How fast is your option pricer? Can it price an American option with 1 basis point (bps) of accuracy in microseconds? Can it calculate the implied volatility of an American option with the same precision, just as quickly? With over 1 million options traded in the U.S., not having a lightning-fast pricer means you'll either struggle to keep up with the market or face skyrocketing hardware and personnel costs. Our option pricer delivers lightning-fast performance with pinpoint accuracy, giving you the edge in today’s high-speed markets.

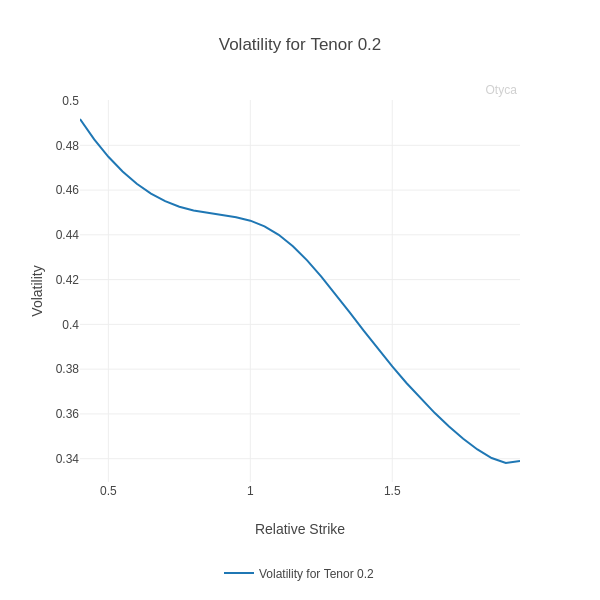

Volatility Fitter: Flexible and Consistent

How well does your volatility fitter perform? A major earnings event can create a "W" shape in the implied volatility curve for expirations immediately following the event. Can your volatility fitter handle such complexities? Do you use a consistent model across all expirations, or do you rely on potentially inconsistent parameters for each option expiration? And when constructing a local volatility grid, how do you manage it without a unified model for the underlying asset? Achieve precise and consistent volatility fitting with our software, designed to handle the full complexity of market dynamics.